When you run a business or an institution, you need to keep track of a lot of thing. One of them being your finance. Finance is all about income and expense. The balance of the two needs to be paid attention to. That is why it is time to create a sample income statement. An income statement is statement that specifies the detail of income and expense in your company. It’s time that you make your company grow by learning to make one.

What Is The Difference Between Balance Sheet And Income Statement?

Some people might confuse an income statement with a balance sheet. To be fair, both of it does closely relate to a company’s finance. The different lies in the content.

A balance sheet is a sheet used to specify the company’s revenue and expense. Meanwhile, an income statement includes details about assets, equity, and liabilities. Therefore, the balance sheet is usually more concise. Meanwhile, the income statement is more comprehensive. Other than that, a balance sheet also reports whether the company is profiting or losing money. On the other hand, an income statement specifies whether the company is spending a lot or not.

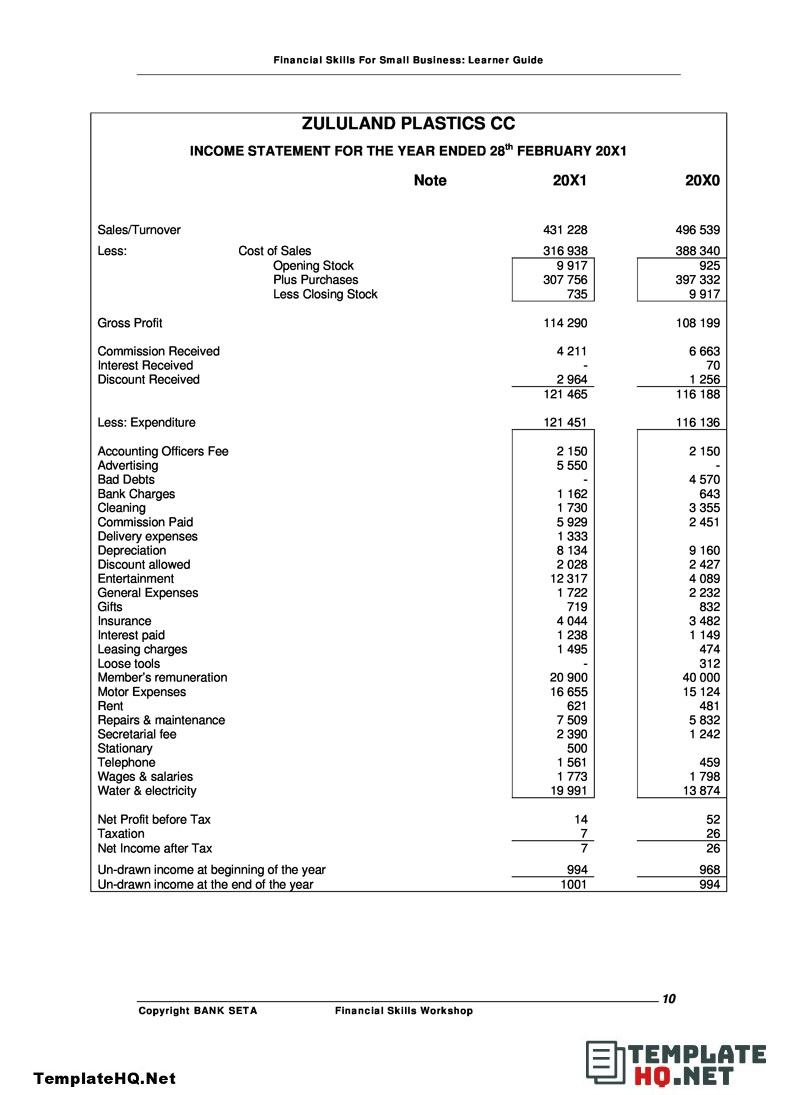

Sample Income Statement for Small Business

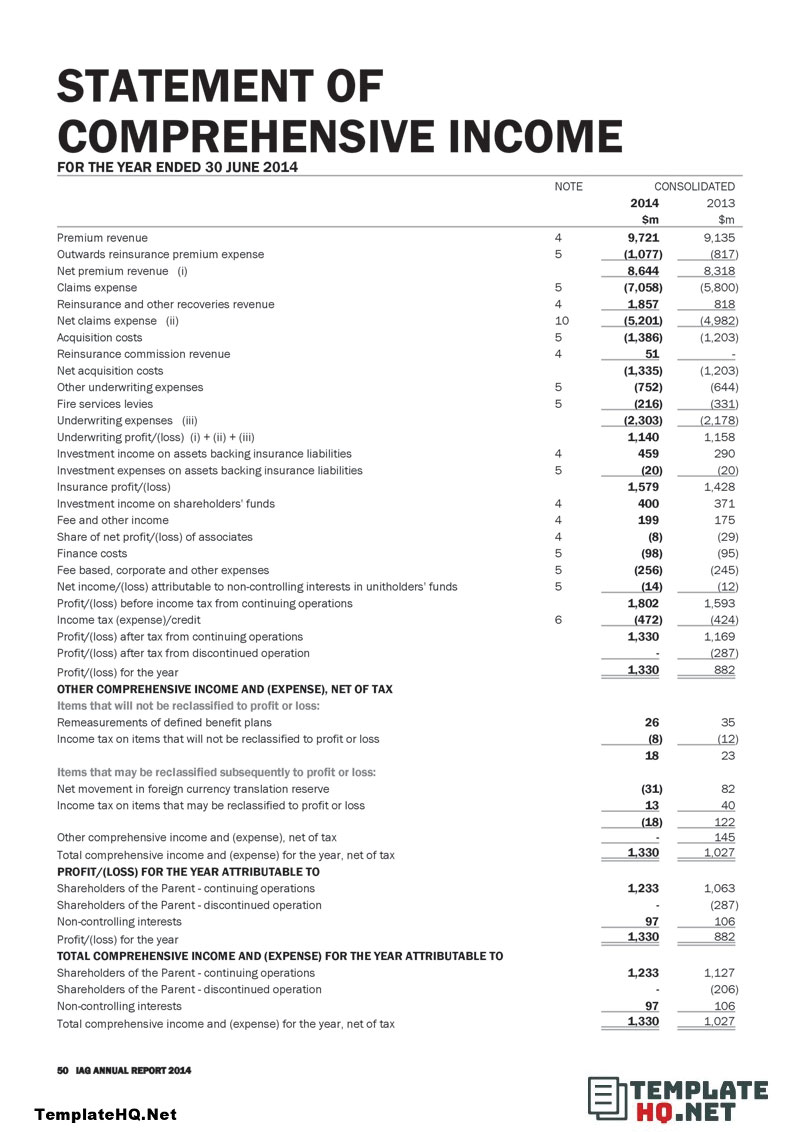

Comprehensive Sample Income Statement Form

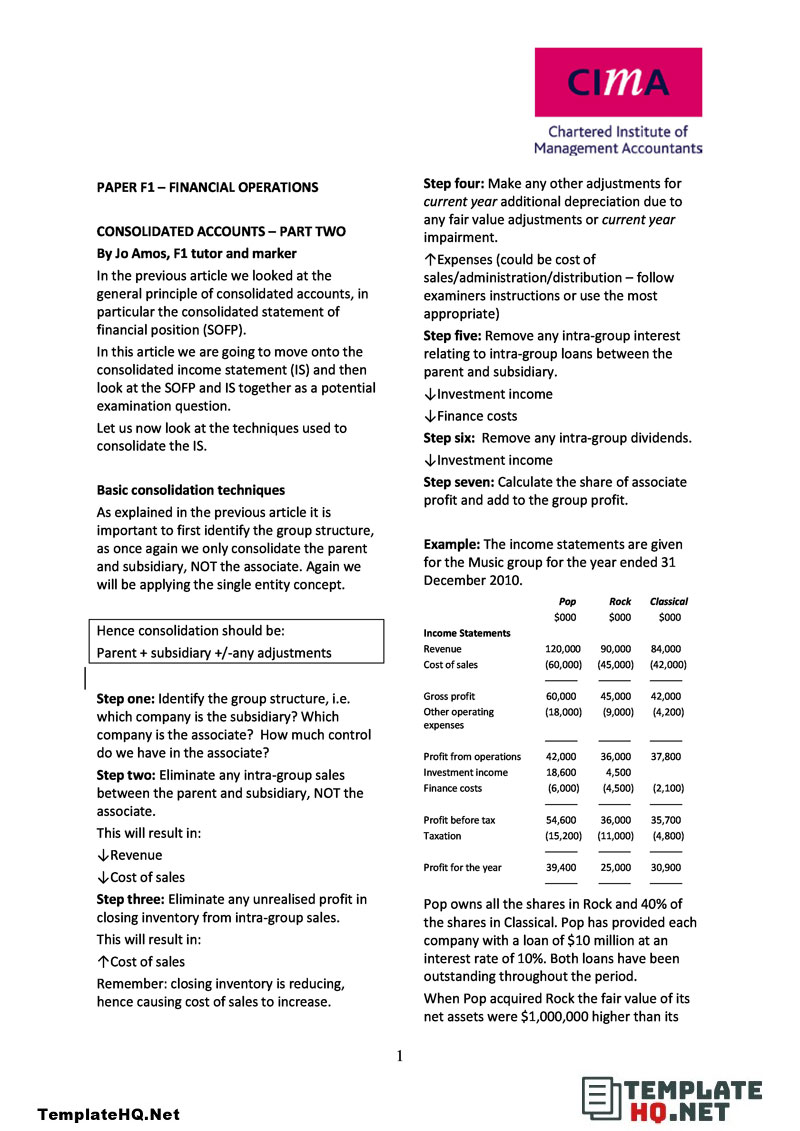

Consolidated Income Statement Form Format

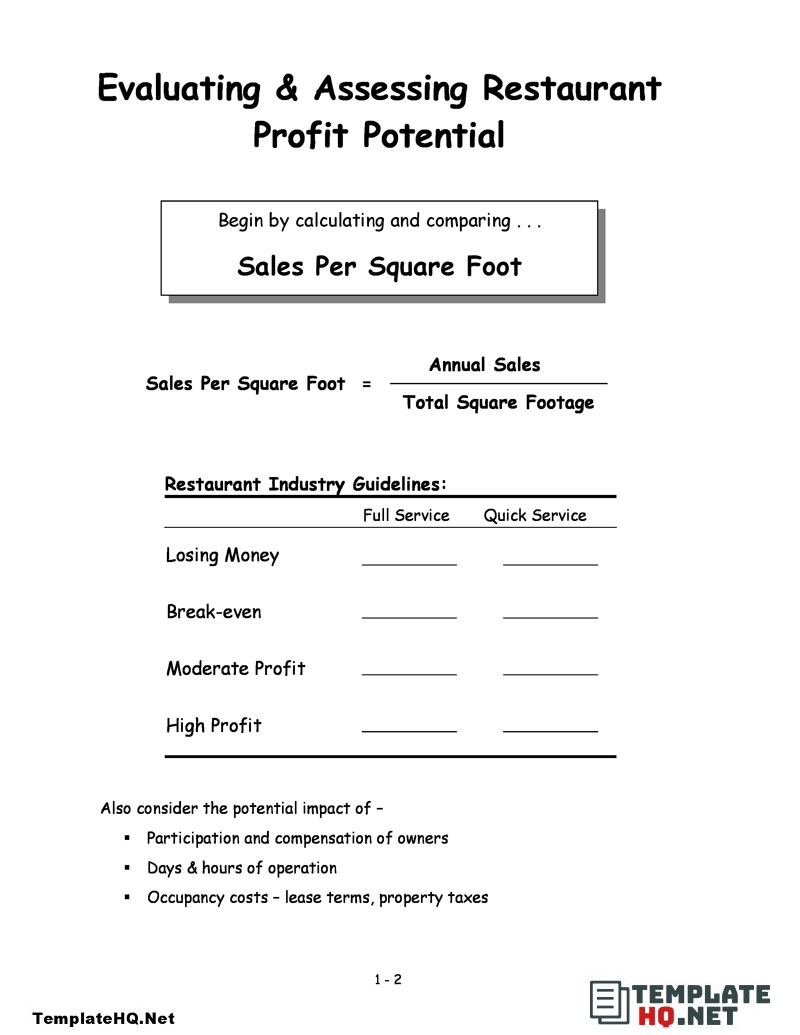

Example Income Statement Form For Restaurant

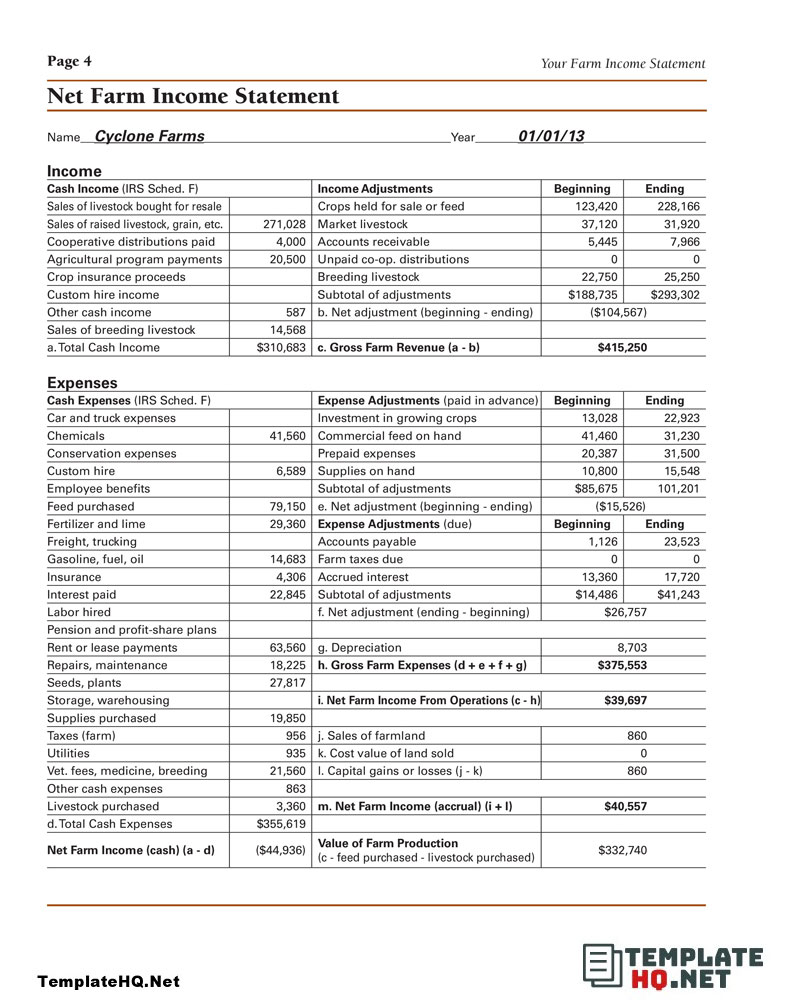

Net Farm Income Statement Form

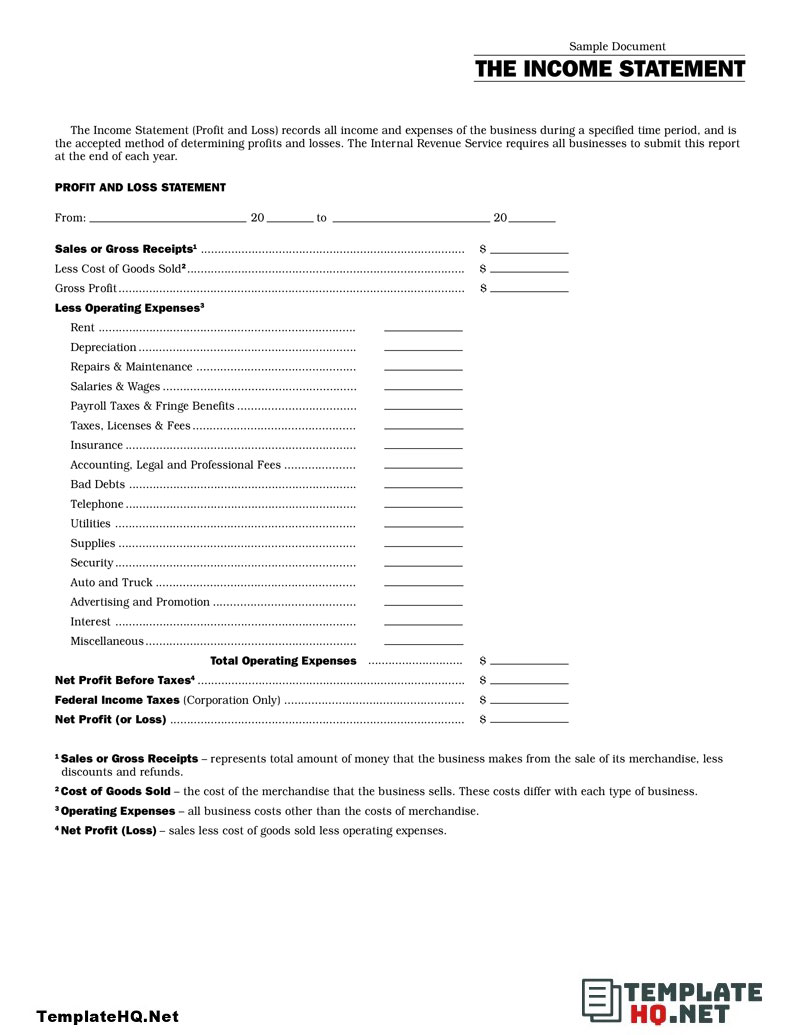

Sample Income Statement Form

What to Include In a Sample Income Statement

Making an income statement is the basics of accounting. Don’t stress if you are not familiar to the world of accountings. Here are a fixed content of an income statement :

a. Asset

Assets are things that your company have. Assets are divided into two categories; current and fixed.

- Current asset

In this section, you should write down the detail of cash, marketable securities, pre-paid liabilities, or other asset that can be used in under one year. - Fixed asset

Fixed assets are stuff that is used for more than a year. It is also a term for stuffs that could produce income. This term encompass stuff like machine, land, property and equipment. - Total asset

Specify the value of current asset and fixed asset. What you want to do next is to total it.

b. Liabilities

On the other hand, liabilities are what your company owe. Your company can have short term liabilities or long term liabilities.

- Short term liabilities

Liabilities that is included in this term are short term loans, accrued expense, prepaid revenues, etc. - Long term liabilities

Liabilities in this sections can only be paid in long term. The example are mortgages, long term loans, etc. - Total liabilities

Similar to total assets, all you have to do is to add both long term and short term liability value.

c. Equity

This section is for the equity that your company have. The source could be from personal equity or equity from other actors.

The Steps Towards Making a Good Income Statement

You’ve paid attention to the sample income statement. To make one, you need to do pay attention to do some things. The first tips is to keep close track on your company’s finance. This should be done throughout the month. Gather data on your income, expense, asset, and other financial aspect. Ask a professional to keep track of it for you. Or, you could keep track of it yourself. This makes sure that you will have a good data to start making a sample income statement.

When you do all of this, make sure to be detailed. A slip in tracking your finance could be lethal. Make sure all financial activity is tracked and mentioned in the statements. Remember that your company’s reputation hinges on a detailed financial statement. For example If investors looks at a doubtful income statement, you’ll lose potential modals for your company.

The next time you want your finance to be organized, refer to our sample income statement. There, you’ll learn how to write down the expense and income from your business. Make sure not to confuse this statement with a balance sheet. Then, use our steps to make a thorough income statement.